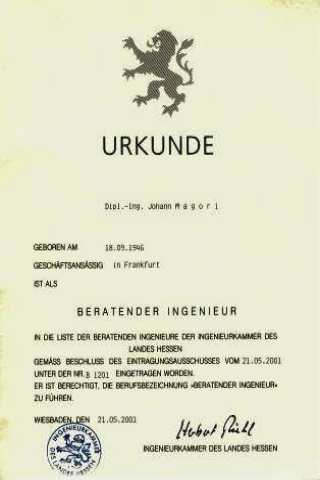

ENGINEERING

- MAGORI -

CONSULTING

BridgeLink AG –

Partner –

– Main Activity – Acquisitions : Equity Link ™

Mergers and Acquisitions (M&A) :

Business Design ™ / Business Control ™

BridgeLink-Trade Mark :

Equity Link™ :

Identification of investors and Private Equity as well as the procurement of suitable financial means

(Growth capital, company purchase, strategical partnerships,... etc.)

Business Design ™ :

Measures and Instruments to the process design in the running company, for the preparation on a company purchase / sell or for the succession regulation.

Business Control ™ :

Instruments to monitor and control the managed company (financial controlling, marketing, organization).

Mergers and Acquisitions (M&A) :

The phrase mergers and acquisitions (abbreviated M&A) refers to the aspect of corporate strategy, corporate finance and management dealing

with the buying, selling and combining of different companies that can aid, finance, or help a growing company in a given industry

grow rapidly without having to create another business entity.

If companies want to grow, - business development, expansion, competitive advantages development -

they need for it, mostly new resources !!!!

( Resources: Know-how, patents, manufacturing capacities.... etc.)

New resources to develop internally ??,

– or – New resources to acquire external ??,

Alliances with other companies ??, – or – mergers - acquisitions ??.

" Development of its own power? "

or

" Partnership? "

or

" Mergers - Acquisitions ? "

( M & A )

( or strive for all !!?? )

Mr. Peter H. Altherr with his systematic, consequence, and proven, clearly structured procedure / process, and

with several years of experience in this area, can contribute to the managerial decision-making and

supports managers to decide, which structures, methods are useful, suitable,

to obtain new resources and,

for the respective situation to find the best model, strategy, tactics.

(...with which strategy the enterprise can be developed.... best of all....

and with it, new potentials to secure...)

With the view and taking into account, the major technological, economical, environmental, social and political trends, movements.

Thinking in systems (as an integrating factor), to create visions in a continuously changing world, Mr. Peter H. Altherr,

supports managers to organize (design) their own company environmentally - socially friendly and more competitive.

Only someone, who understands strategic relationships, connections, context on the market and uses, can long endure on the market.

Good business models, strategy and tactics, set in motion a mechanism, that, its own competitive position further and further supports.

A company can remain competitive if the firm's management their business model – strategy - tactics,

on time and flexible apply to the changing market needs, requirements.

But, certainly, it is an ART, to develop the business model, strategy and tactics, to build competitive advantage.

Objective, motivation, focus, attitude, passion, determination and persistence,

are extremely important, for the successful implementation of a new vision, in your company.

Many companies still identify with their immediately environments and ignore the global interdependencies.

"

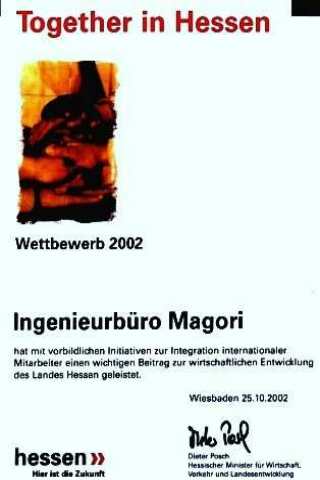

Magori Consulting Ingenieurbüro – Partner (Frankfurt am Main D.) "-

HOME -

"

Peter H. Altherr – Associate Partner bei Remaco Merger AG (Basel Ch.) "- Member of

SECA -

The process accompaniment at the - Mergers & Acqusitions - projects.

Author: © Peter H. Altherr – study: Business Management - and National Economy, at the University of Basle. –

A successful M&A transaction depends strongly from the clear structuralisation,

the consistent adherence to the tried and tested process

and from a rich and personal experience in the M&A-area.

"

Peter H. Altherr – Partner – "

1. M & A – Project.

1. M & A – Project.

The enterpriser boasts to be an expert in his activity area.

Large corporations reflect on her own strengths and concentrate upon her core business.

– Why should a predominantly technical or science-trained board / administrative council / suddenly able to handle a company purchasing professional ?

– Why does the law graduate practicing at one time as an evaluator of assets and the trustee, fiduciary as a mediator?

A successful – M&A transaction –

depends strongly on the clear structure, consistent adherence to the proven process and a rich and personal experience in

M&A field.

– Depending on the nature of the transaction are different processes necessary.

- We distinguish the following types of transactions :

- – Succession planning / regulation in the context of generation change,

- – Management

Buyout [2] /

Management Buyin [3] ,

- – Purchase and sale of companies or participations to third parties,

- – Spin-offs in the context of concentration processes (

Spin-Offs [7] ),

- – Takeovers for strategical reasons,

- – Procurement of growth capital ( Private Equity

[6] )

2. The process-oriented management of M & A -transactions.

2. The process-oriented management of M & A -transactions.

– Depending on the professional orientation of the transaction companion find different approaches to handling :

Thus one finds out over and over again, that, for example, the trustee lays strong weight on the bookkeeping-assessment-methodical elements.

The juridical adviser tends to move the treaty system in the centre and the tax expert tends to a one-sided focus on tax aspects.

– Sure, all these aspects of crucial importance for the successful completion,

but they stand next to each other (side by side) and too often show too many disorganised, uncoordinated interfaces. (These elements are not linear but interconnected network in.)

The consequences are unpleasant and costly surprises during or after the completion of the transaction.

Nothing represents greater " deal killer "

as interruptions in the flow, lack of investigations, few reliable documents,

poorly prepared due diligence

[10],

and not to mention the human, psychological aspects.

3. The Process in details.

3. The Process in details.

- Specifically the – M&A–transaction

process can be divided in the following phases:

- – Decision,

- – Preparation, / implementation

- – Completion and transition

Even the high-level auditors and the designated legal or tax advisors often ignores the fact, that the various phases, are non-linear, but rather like a network related.

"

Therefore, the process must be, by an M&A – specialist,

coordinated, structured, dynamite,

and above all, be done, with psychological skills to successfully reach your target ! "

If necessary, the professional M&A – adviser

provides the procurement of financial resources to enable the transaction, so that the transaction can take place at all.

In the Decision phase, it is to coach the client, in anticipation of future activities and

to create the right foundation for a successful settlement and, if necessary, to ensure funding.

Besides, it can concern very simple questions, but also to involve multi-layered questions / complex issues, to Example:

- – The entrepreneur carries with the thought to sell his company:

But what follows in the meantime, and what happens after the sale?

- – The Supervisory Board has set the goal of joining forces with a strategic partner:

But who is the right partner? How can the necessary discretion to be respected?

- – The Corporate Executive Board has determined to spin off the business section- division XY:

Who supports the new shareholders ?

The spin-off company

[7]

( usually the "outsourced" Regional / Area Manager ) in the search for the necessary capital?

– The preparation and implementation phases often overlap.

It is therefore especially important to ensure a strong management by the professional adviser.

Just in this phase, details are matched, agreed, personal expectations from the buyer or seller coordinated, potential negotiating partners tested, models adjusted and structures

continuously adapted to the latest knowledge, finding.

Here slightest friction or incorrect behaviour / manner can lead to an abrupt failure of the entire

M&A – project.

– Completion and transition are the culmination of the process and represent more than one signature to put on the contract.

Coordination, discipline, and consquenz are here important success factors.

For example, can here, an insufficient consultation, about the how?, when? and what?

in communication to employees and customers, lead to start difficulties and to the danger/ threat of the new company.

– As we all know, is the devil in the detail, and this is especially true, in the area of

M&A transactions.

Therefore a process accompaniment by an

M&A – Professional, is essential, and indespensable,

because this has the necessary knowledge, about trust connections to professional investors,

and above all, about the so crucial long-term, personal M&A- experience.

"

Peter H. Altherr – Partner – "

If companies want to grow, - business development, expansion, competitive advantages development -

they need for it, mostly new resources !!!!

( Resources: Know-how, patents, manufacturing capacities.... etc.)

New resources to develop internally ??,

– or – New resources to acquire external ??,

Alliances with other companies ??, – or – Mergers - Acquisitions ??.

" Development of its own power? "

or

" Partnership? "

or

" Mergers - Acquisitions ? "

( M & A )

( or strive for all !!?? )

Mr. Peter H. Altherr with his systematic, consequence, and proven, clearly structured procedure / process, and

with several years of experience in this area, can contribute to the managerial decision-making and

supports managers to decide, which structures, methods are useful, suitable,

to obtain new resources and,

for the respective situation to find the best model, strategy, tactics.

(...with which strategy the enterprise can be developed.... best of all....

and with it, new potentials to secure...)

With the view and taking into account, the major technological, economical, environmental, social and political trends, movements.

Thinking in systems (as an integrating factor), to create visions in a continuously changing world, Mr. Peter H. Altherr,

supports managers to organize (design) their own company environmentally - socially friendly and more competitive.

Only someone, who understands strategic relationships, connections, context on the market and uses, can long endure on the market.

Good business models, strategy and tactics, set in motion a mechanism, that, its own competitive position further and further supports.

A company can remain competitive if the firm's management their business model – strategy - tactics,

on time and flexible apply to the changing market needs, requirements.

But, certainly, it is an ART, to develop the business model, strategy and tactics, to build competitive advantage.

Objective, motivation, focus, attitude, passion, determination and persistence,

are extremely important, for the successful implementation of a new vision, in your company.

Many companies still identify with their immediately environments and ignore the global interdependencies.

"

Magori Consulting Ingenieurbüro – Partner (Frankfurt am Main D.) "-

HOME -

"

Peter H. Altherr – Associate Partner bei Remaco Merger AG (Basel Ch.) "- Member of

SECA -

" doing the right thing – instead of –

doing things right. "

Why will the wheel be stell invented every day? – Do not Reinvent the Wheel –

– Siehe auch:

- EU - KMU Förderung : - Kommission will Übertragung von Unternehmen unterstützen.

– Siehe auch:

- KfW - Fördermittel - zur Finanzierung von Unternehmensnachfolgen.

" - Meaning is not in things, but in between; – in the iridescence; – the interplay; – in the interconnection; – at the intersection. - "

" Mallarmé "

Article Title.

Article Title.

4. Glossary of Terms. Dokumentation - Bibliography

4. Glossary of Terms. Dokumentation - Bibliography

|

« Terms. Dokumentation - Bibliography » |

LINKS |

[1]Business plan

[1]Business plan

A business plan is a formal statement of a set of business goals, the reasons why they are believed attainable,

and the plan for reaching those goals.

Business plans are decision-making tools.

The content and format of the business plan is determined by the goals and audience.

A business plan should contain whatever information is needed to decide whether or not to pursue a goal.

– Banks are quite concerned about defaults, so a business plan for a

bank loan will build a convincing case for the organization’s ability to repay the loan.

– Venture capitalists are primarily concerned about initial investment, feasibility, and exit valuation.

– A business plan for a project requiring equity financing will need to explain why current resources,

upcoming growth opportunities, and sustainable competitive advantage will lead to a high exit valuation.

"... a good business plan can help to make a good business credible, understandable, and attractive to someone who is

unfamiliar with the business.

Writing a good business plan can’t guarantee success, but it can go a long way toward reducing the odds of failure."

Eric S. Siegel, Brian R. Ford, Jay M. Bornstein (1993),

'The Ernst & Young Business Plan Guide'

(New York: John Wiley and Sons)

ISBN 0471578266

Preparing a business plan draws on a wide range of knowledge from many different business disciplines :

• finance,

• human resource management,

• intellectual property management,

• supply chain management,

• operations management, and

• marketing, among others.

Some of these content areas may be more or less important depending on the kind of business plan.

There is no fixed content for a business plan.

Rather the content and format of the business plan is determined by the goals and audience.

Once a business plan has been developed, the key decision making points are usually summarized in an executive summary.

Content of a business plan (generally):

– 1. Executive Summary

– 2. Organizational Background

– 3. Marketing Plan

– 4. Operational Plan

– 5. Financial Plan

– 6. Risk analysis

– 7. Decision Making Criteria

The specific content will be highly dependent on the core purpose and target audience.

|

|

|

|

[3]Management buy-in (MBI)

[3]Management buy-in (MBI)

A management buyin (MBI) occurs when a manager or a management team from outside the company raises the necessary finance, buys it, and becomes the company's new management.

|

|

|

|

[5]IPO (initial public stock offering )

[5]IPO (initial public stock offering )

An initial public stock offering (IPO) referred to simply as an "offering" or "flotation,"

is when a company issues common stock or shares to the public for the first time. They are often issued by smaller,

younger companies seeking capital to expand, but can also be done by large privately-owned companies looking to become publicly traded

|

|

[6]Private equity

[6]Private equity

In finance, private equity is an asset class consisting of equity securities in operating companies that are not publicly traded on a stock exchange.

Investments in private equity most often involve either an investment of capital into an operating company or the acquisition of an operating company.

|

|

[7]Spin-off

( Corporate spin-off – Spin out )

[7]Spin-off

( Corporate spin-off – Spin out )

Spin out refers to a type of spin off where a company "splits off" sections of itself as a separate business.

The common definition of spin out is a division of a company or organization that becomes an independent business.

The "spin out" company takes assets, intellectual property, technology, and/or existing products from the parent organization.

|

|

[8]Venture capital

( Private Equity; Venture Capital; )

[8]Venture capital

( Private Equity; Venture Capital; )

Venture capital (also known as VC or Venture) is a type of private equity capital typically provided to early-stage, high-potential,

growth companies in the interest of generating a return through an eventual realization event such as an IPO or trade sale of the company.

Venture capital investments are generally made as cash in exchange for shares in the invested company.

|

|

|

|

[10]Due Diligence

[10]Due Diligence

Due Diligence is a term used for a number of concepts involving either the performance of an investigation

of a business or person, or the performance of an act with a certain standard of care.

It can be a legal obligation, but the term will more commonly apply to voluntary investigations.

In business transactions, the due diligence process varies for different types of companies.

Due diligence in business transactions.

The relevant areas of concern may include the financial, legal, labor, tax, IT,

environment and market/commercial situation of the company.

Other areas include intellectual property, real and personal property, insurance and liability coverage,

debt instrument review, employee benefits and labor matters, immigration, and international transactions.

Gary M. Lawrence,

Due Diligence in Business Transactions.

(

Law Journal Press 1994.

)

ISBN 9781588520661

|

|

[11]Finanzsystem

[11]Finanzsystem

Brandbeschleuniger im Finanzsystem.

von Martin Hellwig

Prof. Dr. Martin Hellwig ist seit 2004 Direktor am Max-Planck-Institut zur Erforschung von Gemeinschaftsgütern in Bonn.

Seine Laufbahn führte ihn unter anderem an die Universitäten Stanford, Princeton, Harvard und Basel.

Hellwig beschäftigt sich mit Informationsökonomik, öffentlichen Gütern und Steuern sowie mit Finanzmärkten und -institutionen.

Er ist Vorsitzender des Lenkungsrats des Wirtschaftsfonds Deutschland.

Copyright © 2009, Max-Planck-Gesellschaft, München.

|

|

Top

Top

ENGINEERING

- MAGORI -

CONSULTING